Capital Gains Tax On Real Estate And Selling Your Home

Table Of Content

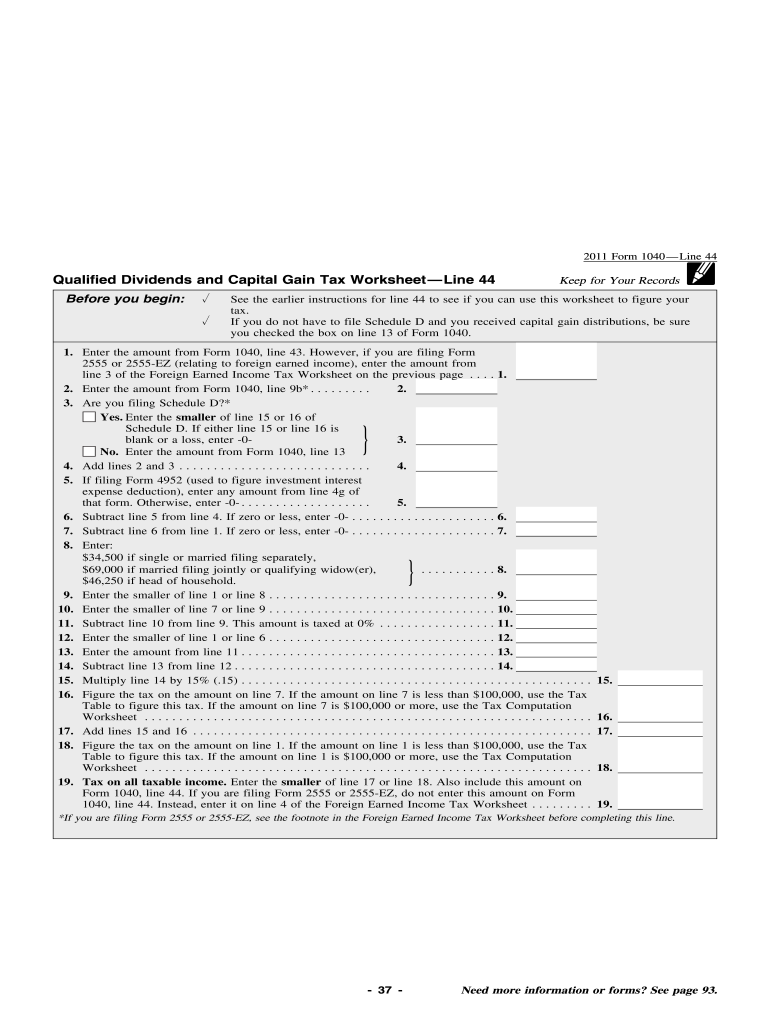

To determine how long you held the asset, you generally count from the day after the day you acquired the asset up to and including the day you disposed of the asset. In most, but not all situations, the profits you make upon the profitable sale of an asset are taxable. Since it is a tax being applied to a capital gain, it is appropriately known as a capital gains tax. In this article, we'll discuss the two main types of capital gains, how each one is taxed, and some real-estate-specific rules you need to know. For single folks, you can benefit from the 0% capital gains rate if you have an income below $44,625 in 2023.

'It's chaos': Cottage owners rush to sell ahead of capital gains tax changes, realtors say - The Globe and Mail

'It's chaos': Cottage owners rush to sell ahead of capital gains tax changes, realtors say.

Posted: Wed, 24 Apr 2024 22:46:41 GMT [source]

How we make money

You realize a capital gain when you sell your home, according to the CRA's website. You don't have to pay tax on the gain if the property was solely your principal residence for every year you owned it. A principal residence applies to a house, cottage, condominium, apartment in an apartment building or duplex, trailer, mobile home or houseboat that an individual usually inhabits. The federal government's proposed change to capital gains taxation is expected to increase taxes on investments. The questions surrounding the sale of Mr Rayner’s property are relevant as Ms Rayner has yet to respond to questions about whether she paid capital gains tax on the sale of her own house.

When do I pay the capital gains tax on real estate?

Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information. Also, you’ll have to complete and attach Form 8997 to your return. The 8997 lets the IRS know of the QOF investment and the amount of gain deferred, among other information. The longer one holds a QOF investment, the more tax incentives there are.

The Home Sale Tax Exemption - FindLaw

The Home Sale Tax Exemption.

Posted: Fri, 08 Sep 2023 07:00:00 GMT [source]

How Much Is Capital Gains Tax on Real Estate?

Owning the home isn't enough to avoid capital gains on the sale — the IRS also wants to make sure that you actually intended to live in the house, at least for a certain period of time. Living in the home for at least two of the five years helps to establish this. The IRS is flexible here — the 24 months don't have to be consecutive, and temporary absences, such as vacations, also don't count as being "away." In general, to qualify for the Section 121 exclusion, you must meet both the ownership test and the use test.

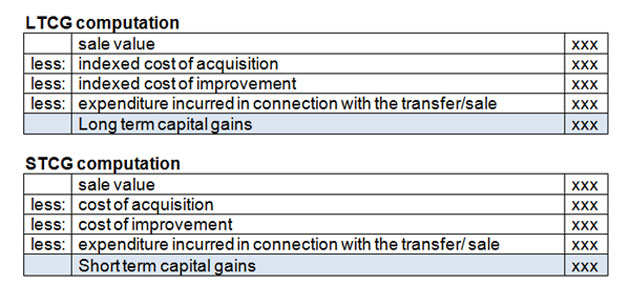

Saskatoon Public Schools says budget increase won't cover growing enrollment or class complexity

First, if you sell the property for a net profit relative to your cost basis, you'll have to pay capital gains tax. You can also reduce the amount of capital gains subject to capital gains tax by the cost of home improvements you’ve made. The higher your adjusted cost basis, the lower your capital gain when you sell the home. If you sell the home after you hold it for longer than one year, you have a long-term capital gain.

Many real estate investors engage in 1031 (like-kind) exchanges. In a 1031 exchange, a real estate investor sells their current property, but then rolls the proceeds into a new investment opportunity and postpones their capital gains taxes indefinitely. It’s also important to know the type of asset you’re dealing with. While most long-term capital gains are taxed at rates of up to 20% based on income, there are situations in which higher rates apply.

Capital gains are also subject to state taxes, with the amount varying from state to state. Using the same example from above, assuming $700,000 in capital gains and a 15% tax, you will owe $105,000 in federal taxes when you sell your home. So assuming you buy your home in 2014 for $500,000, your basis in your home is $500,000. Your basis is the purchase price ($500,000), plus purchase expenses, plus the cost of capital improvements, minus any depreciation and minus any casualty losses or insurance payments. As your home grows in value, your basis generally stays the same unless you improve your home (remodel). If you sold furniture, drapes, lawn equipment, a washer/dryer, or other property that wasn’t a permanent part of your home, report the amount you received for the items as ordinary income.

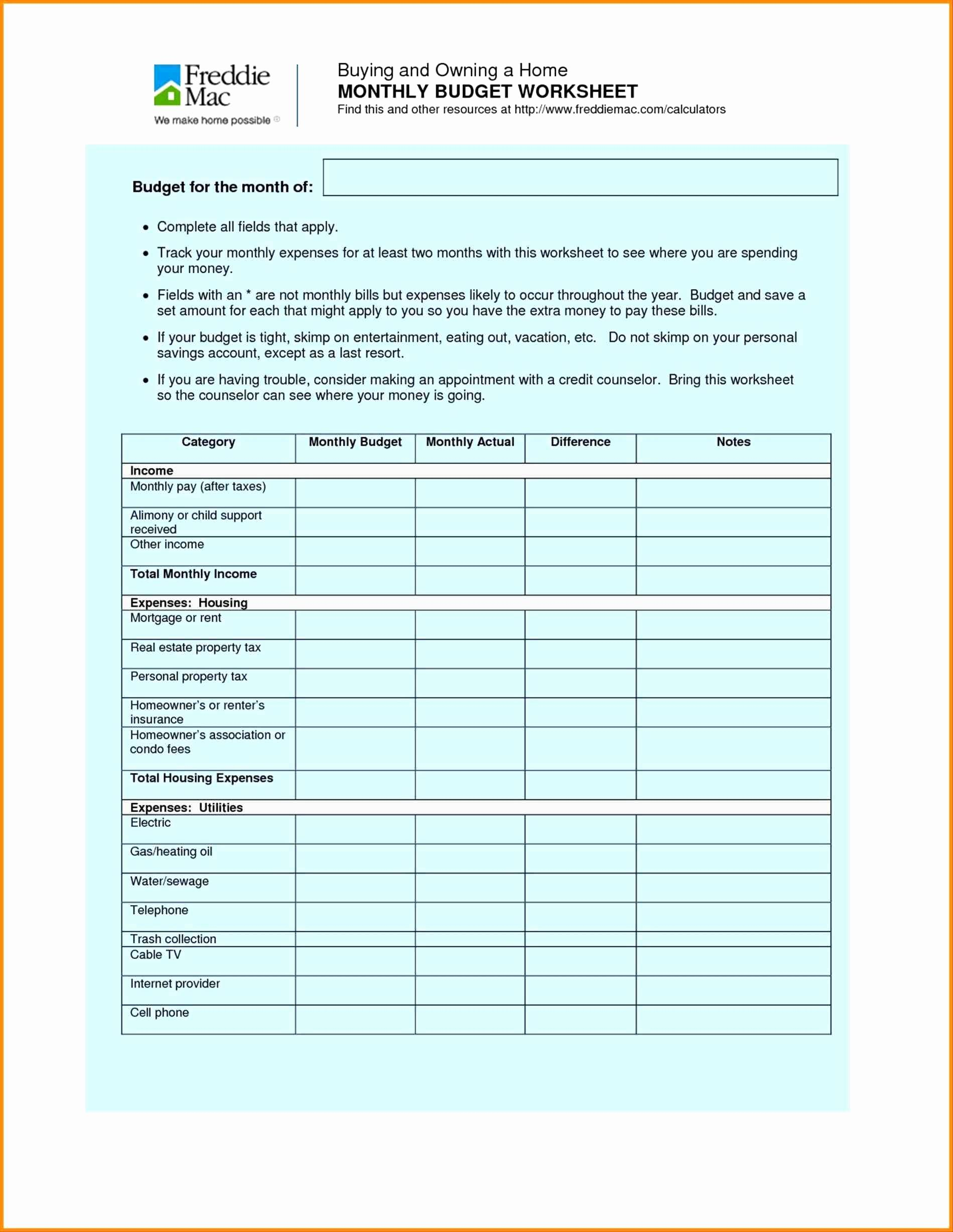

For each number on your “Total” worksheet, figure the business-related portion of that number and enter it on your “Business or Rental” worksheet. You may use different methods to determine the business portion of different numbers. Here are the three possible methods and the circumstances under which each method applies. If your home was foreclosed on, repossessed, or abandoned, you may have ordinary income, gain, or loss. Settlement costs don’t include amounts placed in escrow for the future payment of items such as taxes and insurance. Selling your second home isn't just about finding the right buyer or getting the best price.

Nordea Asset Management: Uniting Investors to Confront Rising Menace of Methane

As a result, make sure to talk to your tax adviser if you're contemplating a like-kind swap. The first is for so-called unrecaptured Section 1250 gain, which applies if you took depreciation deductions in the past for the office or rental space. (This is discussed in more detail below.) If you used the simplified method to claim home office deductions on your return, you don't have to worry about this. Real estate gift tax applies any time an individual transfers property to someone without receiving full market value in return.

If you owned the home for at least 24 months (2 years) out of the last 5 years leading up to the date of sale (date of the closing), you meet the ownership requirement. For a married couple filing jointly, only one spouse has to meet the ownership requirement. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

To qualify as your primary residence, the IRS requires that you prove the property was your main home where you lived most of the time. You’ll need to show that you owned the home for at least two years and lived in the property as your primary residence for at least two of the five years immediately preceding the sale. Homeowners pay property taxes to local governments to help cover the cost of community services. You can also deduct any repairs or renovations you made to an investment property to improve the final selling price of the home. Remember to keep documentation such as mortgage statements, bills, deeds of sale, credit card statements and other similar papers to prove how much you spent. In situations like this, it's important to seek the advice of a qualified professional, such as a tax attorney or a reputable and experienced tax professional.

Realizing a large profit at the sale of an investment is the dream. For owners of rental properties and second homes, there is a way to reduce the tax impact. To reduce taxable income, the property owner might choose an installment sale option, in which part of the gain is deferred over time. A specific payment is generated over the term specified in the contract. Homeowners can take advantage of the capital gains tax exclusion when selling a vacation home if they meet the IRS ownership and use rules. But a second home will generally not qualify for a 1031 exchange (see below).

This rule even allows you to convert a rental property into a principal residence because the two-year residency requirement does not need to be fulfilled in consecutive years, just cumulative months. The Liberals said the change will not affect 99.87 per cent of Canadians and does not apply to the sale of primary residences. It is expected to rake in $19.3 billion over the next five years. John Fincham, a broker with Re/Max Parry Sound Muskoka Realty in Muskoka, Ont., recently told BNN Bloomberg the change could cause a correction in the cottages and recreational property market. Some owners may rush to sell before the higher tax rules kick in amid soaring values of the properties in recent years. Many Canadians could feel the impact of this tax change, such as through the sale of their cottages and other secondary residences, or rental properties.

Comments

Post a Comment